5 Reasons USA Automotive Buyers Lose Money With Overseas Precision Component Suppliers — And How to Fix It

A Technical Guide for Automotive Procurement, QA & Manufacturing Engineering Teams

USA automotive teams operate in a contradiction.

Overseas suppliers promise low-piece pricing—yet the total cost of ownership keeps climbing.

OEM line stoppages still average $22,000 per minute, EV components routinely require ±0.02 mm tolerances, and 72% of OEMs outsource tooling to Asia, increasing exposure to dimensional drift, QC failures, and documentation gaps.

What follows is a structured breakdown of why USA buyers lose money, how the failures occur, how they show up financially, and what “good” looks like in supplier performance.

Reason 1: Tolerance Drift & Dimensional Instability Over Time

Why It Happens

Most low-cost shops still rely on:

- Manual caliper checks instead of CMM/SPC

- Uncalibrated metrology rooms

- Aging equipment with thermal deviation

- No DOE or scientific molding

- No inter-cavity balancing

A Deloitte study indicates nearly 29% of manufacturing defects originate from poor dimensional control or improper tolerance management—confirming that drift is an industry-wide cost driver.

A precision-forging study also found 15 defective parts in a batch of ~3000, caused by unpredictable deformation, validating that one good T1 sample means nothing without repeatability.

How It Costs You Money

- PPAP failures

- NCR-driven scrap

- Tooling rework

- Warranty/field failure exposure

- Line disruption and rescheduling

What Good Looks Like

✔ Full CMM layouts for FAI and PPAP

✔ Cpk ≥ 1.67 on critical features

✔ Inter-cavity variation reports

✔ Controlled, calibrated metrology room

If a supplier can’t prove precision, they cannot sustain precision.

Reason 2: Missing PPAP Level 3, Traceability & Certifications

Why It Happens

Many overseas vendors lack:

- Document control systems

- PFMEA/DFMEA discipline

- Traceability infrastructure

- Capability to generate Cpk/Ppk studies

- Calibrated metrology for valid PPAP data

McKinsey reports that supplier-side failures account for ~40% of automotive recalls—often tied to weak documentation, traceability gaps, and process variation.

How It Costs You Money

- Shipments held unapproved

- Failed audits and escalations

- Emergency local sourcing

- Rework, re-inspection, and air freight

- Delayed launch readiness

What Good Looks Like

✔ PPAP Level 3 (mandatory, not optional)

✔ Full GD&T dimensional reports

✔ Resin & steel lot traceability

✔ Heat treatment & hardness validation

✔ 8D problem-solving capability

Missing documentation is not clerical—it’s a compliance and cost risk.

Reason 3: Tooling Design Flaws (No Moldflow, No DFM, No Stack-Up Analysis)

Why It Happens

High-risk suppliers often skip:

- Moldflow/Moldex3D simulation

- Tolerance stack-up analysis

- Cooling channel optimization

- Gate balance evaluation

- Material shrinkage compensation

Deloitte research shows over 30% of tooling delays come from design-stage errors, not machining—meaning poor DFM is the single biggest early-stage cost amplifier.

How It Costs You Money

- Shrinkage & warpage

- Flash, sink, short shots

- Multi-cavity imbalance

- Increased cycle time

- Assembly failures even when features “pass tolerance”

What Good Looks Like

✔ Annotated DFM (red/amber/green)

✔ Moldflow (fill, warp, cooling, weld-line map)

✔ Tolerance chain diagrams

✔ Certified steel selection

Tools built without simulation always cost more later.

Reason 4: Lead-Time Variance, Missed SOP Dates & Delivery Risk

Why It Happens

Common weaknesses include:

- Overloaded project managers

- No APQP timeline or Gantt control

- Inconsistent trial scheduling

- No forecasting

- No buffer inventory

- Port/customs delays without mitigation

Global supply-chain studies show 70% of missed SOP dates can be traced back to poor supplier communication or tooling-stage delays.

How It Costs You Money

- Air freight

- Emergency engineering changes

- Line validation delays

- Overtime for QA/program teams

- Higher TCO despite lower RFQ price

What Good Looks Like

✔ DFM: 2–4 days

✔ Moldflow: 1–2 days

✔ T1 samples: 2–4 weeks

✔ Weekly engineering updates

✔ Trial videos + QC photos

✔ Forecast-driven planning

Predictability—not low price—is the true cost saver.

Reason 5: Weak Process Control: No SPC, No Scientific Molding, Batch Variation

Why It Happens

Low-tier suppliers frequently:

- Skip scientific molding

- Change parameters mid-run

- Use uncalibrated machines

- Ignore DOE validation

- Produce no SPC data

According to multiple quality studies, process instability contributes to 45–60% of in-production dimensional failures, especially in EV plastics and connectors.

How It Costs You Money

- Dimensional drift mid-batch

- Rejected subassemblies

- High scrap rates

- Warranty and field exposure

What Good Looks Like

✔ Scientific molding documentation

✔ DOE-based process windows

✔ SPC trend charts (X̄–R, Cpk/Ppk)

✔ Multi-cavity capability reports

✔ Production validation (PV)

Batch inconsistency is the costliest supplier failure mode.

The Reality: Low Unit Cost ≠ Low Total Cost

Hidden costs from weak suppliers include:

- PPAP rejections

- NCRs and scrap

- Tooling rework

- Emergency freight

- SOP delays

- Warranty exposure

- Line stoppage ($22,000/minute)

USA automotive buyers lose money not at RFQ—but during launch and production.

What “Good” Looks Like in a High-Reliability Supplier

A capable partner should be IATF-aligned and APQP-ready, offering:

- PPAP Level 3

- CMM + SPC for each batch

- Moldflow + DFM before tooling

- Scientific molding & validated windows

- Steel certification + hardness mapping

- Resin/steel traceability

- ±0.02 mm precision capability

- Predictable T1/T2 timelines

- Multi-cavity balancing

- Real-time engineering communication

This combination eliminates the 5 risk factors that explode your TCO.

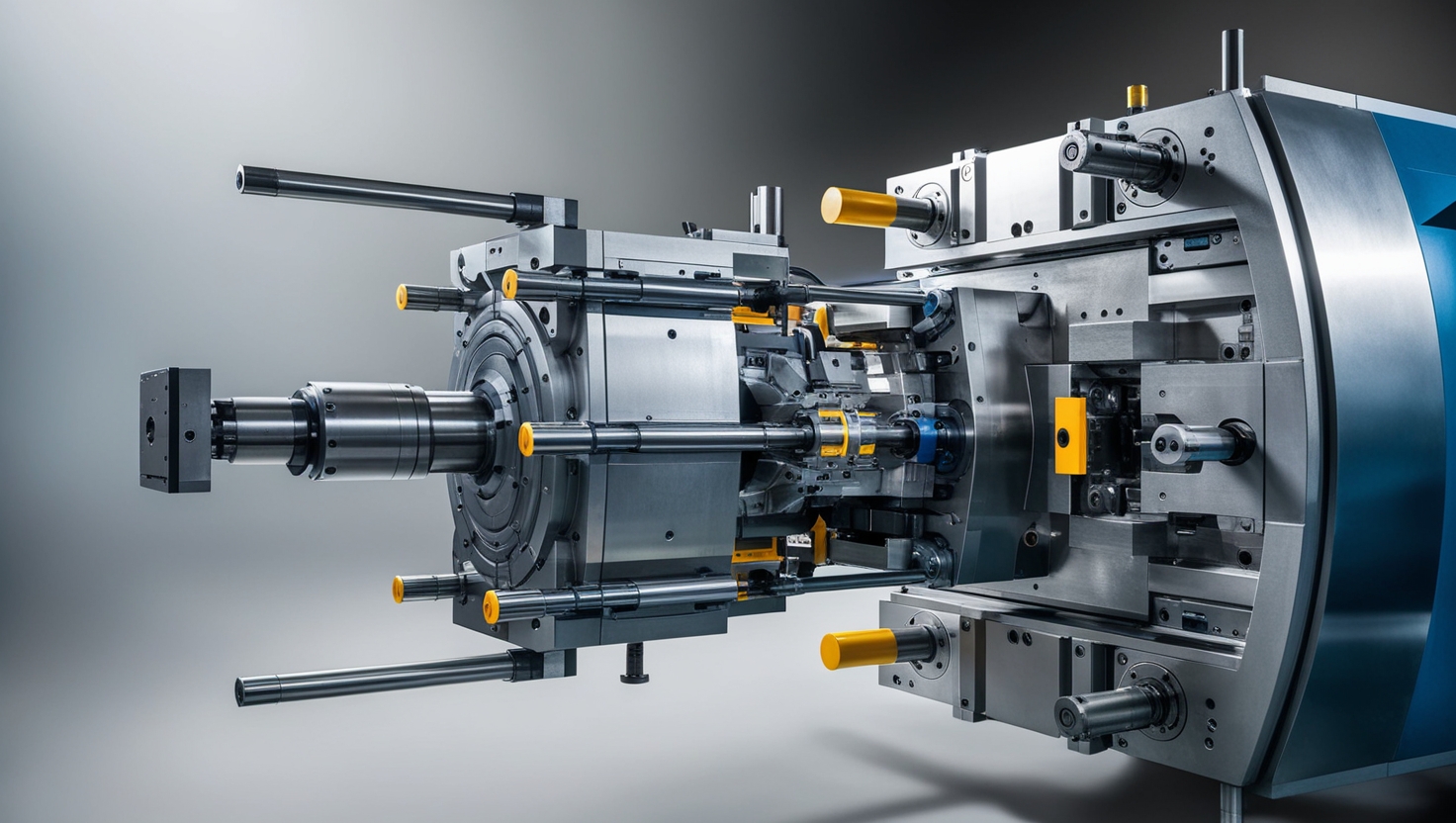

ACE Mold — A Practical Example of an Automotive-Grade Precision Partner

ACE Mold (ACE Group), founded in 2006, operates a 6,000 m² facility in Dongguan with ~150 employees and 25+ years of mold-making experience.

1. Engineering Discipline

- Mandatory DFM

- Moldflow simulation

- Gate/cooling optimization

- Full tolerance stack-up

- Certified steel (H13, S136, P20, 718)

2. Metrology & Documentation

- CMM inspection for every batch

- SPC trend data

- Traceable resin/steel lots

- PPAP Level 3

- Digital QC documentation

3. Precision Capability

- Mold tolerance: ±0.002 mm

- Part tolerance: ±0.005 mm (±0.002 mm via CNC)

- 38 CNC, 15 EDM, 8 Wire EDM, 3 CMM units

4. Predictable Delivery

- Quotes in 2 days

- DFM in 4 days

- T1 in 2–3 weeks

- Weekly updates

- Local warehousing options

5. Automotive Experience

Roof components, water tanks, radiator grilles, high-precision housings, and more.

With 96% customer retention, ACE demonstrates exactly what it means to manage risk, quality, documentation, and precision.

Final Word: Procurement Isn’t Buying Parts — It’s Buying Controlled Precision

USA automotive buyers really pay for:

- Controlled tolerances

- Predictable OTIF

- PPAP Level 3 readiness

- Traceability

- Dimensional stability

- Lower probability of line stoppage

ACE Mold doesn’t just ship parts rather it eliminates the five failure modes that cost automotive buyers money.

If you want a PPAP-ready, documentation-strong, engineering-driven tooling partner, ACE Mold provides the precision and predictability automotive programs require.