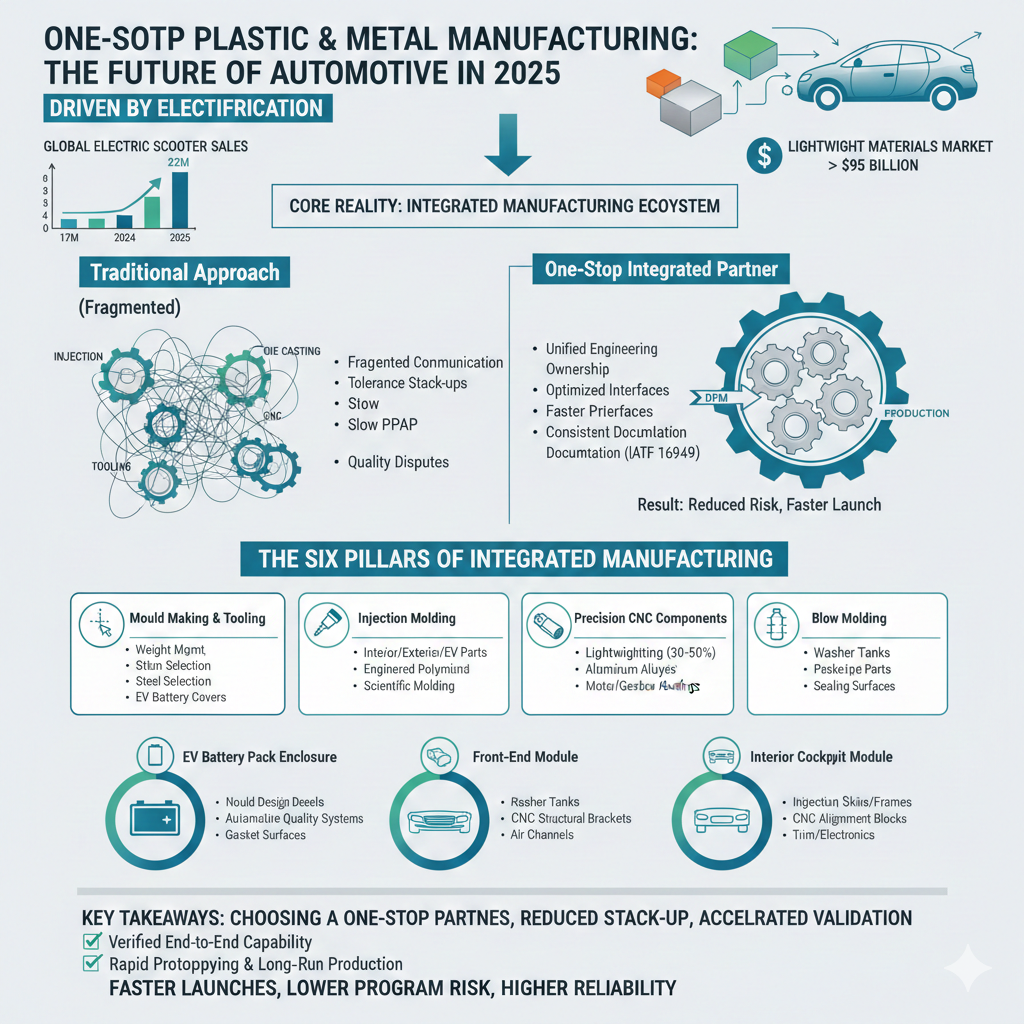

The global automotive industry enters 2025 amid major structural shifts. Electrification is accelerating rapidly: the International Energy Agency (IEA) reports global electric scooter sales exceeded 17 million units in 2024, up more than 25% year-over-year. These ratios are on track to reach 22 million units by the end of 2025 as OEMs expand EV lineups and governments tighten emissions targets.

This shift is driving demand for lightweight, heat-resistant plastic and metal components. Automotive plastics surpassed USD 44 billion in 2024 and are projected to grow steadily through 2033. While the broader lightweight materials market, including aluminum, engineered polymers, composites, and magnesium alloys, exceeds USD 95 billion.

For OEMs and Tier-1/Tier-2 suppliers, these pressures reinforce a core reality: long-term competitiveness requires treating plastics, and tooling as an integrated manufacturing ecosystem.

The following sections outline the key categories enabling that integrated approach.

Automotive Manufacturing Pressures in 2025. Why Integrated Plastics & Metals Suppliers Matter for Automotive

Automotive production historically relies on distributed supplier bases, one vendor for injection molding, another for die casting, others for CNC machining, blow molding, and tooling. While common, this approach often creates inefficiencies:

- Fragmented communication between design, tooling, molding, and casting teams.

- Tolerance stack-ups across plastic–metal interfaces.

- Slower PPAP cycles due to multi-party alignment.

- Increased quality disputes, especially on cosmetic or fit-critical components.

- Extended ramp-up timelines during engineering changes.

By contrast, a one-stop plastics and metals partner enables a cohesive, tightly coordinated engineering environment:

- Unified engineering ownership from DFM to tooling to serial production.

- Optimized interfaces between injection-molded parts, cast components, and precision-machined features.

- Faster problem resolution during PPAP, launch, and mid-cycle updates.

- Consistent documentation and traceability, aligned to IATF 16949 and OEM requirements.

For sourcing and program managers, integrated manufacturing reduces supplier count, minimizes launch risk, and creates a repeatable framework for future platforms.

Category 1 – Mould Design for Automotive Components

Mould design is one of the highest-value engineering levers in automotive manufacturing. With vehicles incorporating more trim variations, sensor integrations, EV-specific housings, and under-hood thermal challenges, DFM must be more rigorous than ever.

Key design considerations include:

- Wall thickness optimization to manage weight while preventing sink marks.

- Rib and boss geometry to ensure stiffness without flow hesitation.

- Gate positioning and runner design for consistent fill on long components such as pillar trims.

- Cooling channel placement to reduce cycle time and minimize warpage.

- Resin selection tailored to chemical exposure, temperature loads, or UV durability.

Examples of components shaped by advanced mould design include instrument panel trim, front grille inserts, EV battery covers, inverter housings, and radar/sensor bezels.

Category 2 – Mould Making & Tooling for High-Volume Automotive Programs

As vehicle lifecycles grow more complex and facelifts more frequent, tooling durability and serviceability have become strategic assets. High-volume automotive programs require:

- Precision CNC machining and EDM accuracy for cores, cavities, and slides.

- Controlled steel selection (H13, S7, P20, etc.) engineered for long shot life.

- Repeatable spotting and fitting to maintain tight parting lines.

- Tool cooling optimization to enhance throughput and dimensional stability.

- Ease of modification for running changes during model refreshes.

For components interfacing with metal reinforcements, seals, clips, or ADAS fixtures, maintaining consistent tolerances is essential to vehicle performance, safety, and long-term reliability.

Category 3 – Injection Molding for Interior, Exterior & EV Systems

Injection molding underpins a wide range of interior, exterior, and EV subsystems. As vehicles integrate more electronics and structural plastics, the performance expectations for molded components steadily rise.

Applications Across Vehicle Domains

- Interior: Consoles, HVAC vents, pillar trims, switch housings, decorative panels.

- Exterior: Lamp housings, mirror assemblies, bumper inserts, sensor bezels.

- EV Systems: Battery module covers, high-voltage connector housings, power electronics enclosure.

Engineered polymers like PC/ABS, PBT, PA66-GF, TPE, and high-temp PPS have become standard for structural and electronic components.

What Automotive Teams Prioritize

- Wide tonnage range for diverse part sizes.

- Clear process documentation compliant with PPAP and IATF audits.

- Scientific molding principles ensure repeatability and traceability.

- Capability with UL-listed, flame-retardant, and high-temperature resins.

With plastics representing more than half of all lightweight material usage in modern vehicles, custom molding suppliers must support increasing design complexity.

Category 4 – Die Casting for Lightweight Structural & Powertrain Parts

Die casting plays a central role in vehicle lightweighting, critical for EV range improvement and ICE efficiency. Aluminum alloys offer high strength-to-weight ratios, corrosion resistance, and excellent dimensional stability.

Common Die-Cast Automotive Components

- Motor and inverter housings

- Gearbox casings

- Structural mounting brackets

- Cross-members and suspension link elements

Aluminum weighs roughly one-third that of steel, and replacing multi-piece steel structures with single die-cast components can reduce mass by 30–50%, depending on geometry.

Integrating die casting with secondary machining allows tighter control over sealing faces, bearing seats, and GD&T-critical surfaces. These are the areas where powertrain and e-drive systems cannot tolerate variation.

Category 5 – Precision CNC Components in Automotive Systems

Precision machining remains essential for high-value components where tolerances impact safety, noise levels, sealing performance, or structural loads.

Typical CNC-Finished Parts

- Machined surfaces on die castings.

- Alignment features for ADAS sensor mounts.

- Precision brackets or blocks used in interiors and chassis.

- Prototype parts for DV/PV validation.

Automotive tolerances often require micrometer-level precision; machining must deliver repeatability, stable surface finishes, and robust dimensional capability (Cp or Cpk) to meet PPAP expectations.

Category 6 – Blow Molding for Fluid, Air & Protection Components

Blow molding supports many hollow, lightweight parts essential to both EV and ICE platforms:

- Washer tanks

- Coolant and expansion reservoirs

- Air ducts and resonators

- Protective covers

- Under-floor storage components

These parts require complex, space-efficient geometries that fit within tight packaging constraints. Importantly, they must align with mounting points created by injection-molded clips or die-cast brackets.

The same combination of blow-molded housings, and precision-machined components also appears in compact urban mobility solutions, including Eco-Friendly Electric Scooters. This is the device where durability, lightweighting, and vibration control parallel automotive requirements are fulfilled.

How Integrated Processes Support Real Automotive Programs

Across global OEM platforms, successful component launches increasingly depend on the synchronization of plastics, metals, and tooling. Consider three representative examples:

EV Battery Pack Enclosure

- Injection-molded covers with integrated cooling and sealing features.

- Die-cast thermal plates.

- CNC-machined gasket surfaces to ensure compression uniformity.

Front-End Module

- Molded grilles, bezels, lamp housings, pedestrian-protection trim

- Die-cast structural brackets

- Blow-molded air channels and HVAC routing components

Interior Cockpit Module

- Molded skins and structural frames

- Machined alignment blocks

- Integrated trim and electronics mounts

Integrated manufacturing minimizes communication handoffs, reduces dimensional stack-up, and accelerates validation cycles, critical advantages as OEMs shrink development timelines.

Conclusion – Selecting a One-Stop Partner for 2025 and Beyond

Automotive and EV manufacturers evaluating suppliers in 2025 should prioritize:

- Verified end-to-end capability across mould design, tooling, injection molding, die casting, CNC machining, and blow molding.

- Strong alignment with automotive quality systems IATF, PPAP, traceability.

- Ability to support rapid prototyping, engineering changes, and long-running production.

- Deep engineering DFM support across polymers, aluminum alloys, and hybrid assemblies.

As electrification accelerates and engineering complexity rises, treating plastics and metals as a single integrated manufacturing ecosystem is emerging as a structural advantage for OEMs and Tier-1/Tier-2 suppliers. Manufacturers who embrace this model achieve faster launches, lower program risk, and higher long-term component reliability.